Institute for Consumer

Antitrust Studies

The

Institute for Consumer Antitrust

Studies is an independent academic

center that explores the impact

of antitrust enforcement on the

individual consumer and the

public, and shapes policy issues.

The institute, directed by Professor

Spencer Weber Waller since 2000,

promotes a comprehensive, inclusive

view of the benefits of competition

law and policy that goes beyond a

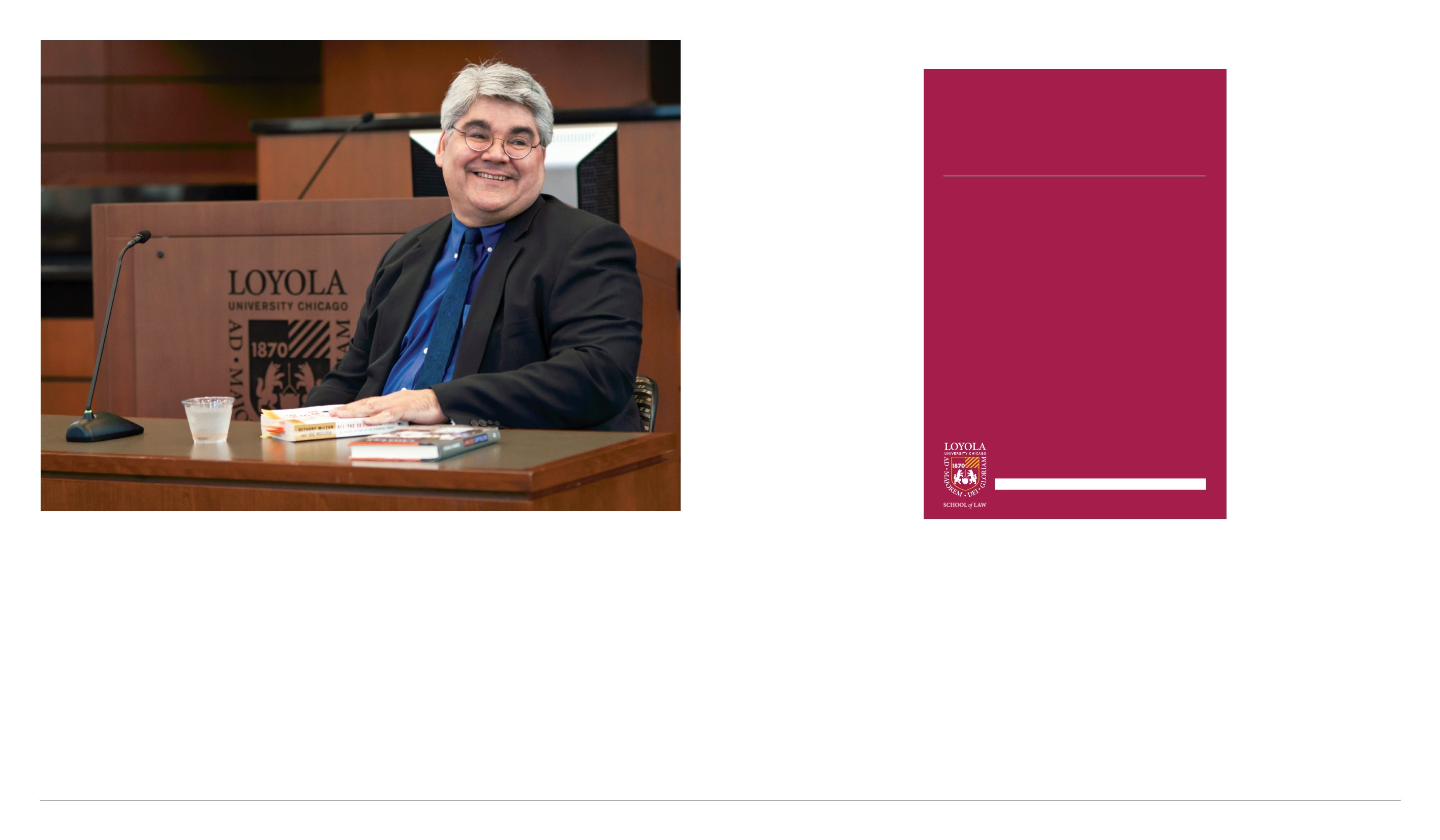

Steven Ramirez, director of the Center for Business and Corporate Governance Law, spoke on the causes and effects of the subprime meltdown at a recent Loyola program.

prevailing narrow focus on

economic efficiency.

Highlights of the past year

include The National Mortgage

Settlement Conference, cohosted

by Loyola’s Institute for Investor

Protection and Center for Business

and Corporate Governance Law,

which commemorated the one-year

anniversary of the historic $50 billion

settlement involving the nation’s

leading home mortgage lenders.

Speakers included US Secretary of

Housing and Urban Development

Shaun Donovan and Illinois Attorney

General Lisa Madigan (JD ’94). A

conference video is available at

LUC.edu/antitrust. Other institute

highlights include the symposium

“Brands, Competition, and the Law”

and the 14th annual Loyola

Antitrust Colloquium.

Center for Business

and Corporate

Governance Law

The Center for Business and

Corporate Governance Law is a

response to rapid changes in

today’s society, from downsizing

and global competition to

explosive new technologies.

Faculty, practicing attorneys,

jurists, and business professionals

provide students with unique

opportunities to learn about

practical aspects of converging

legal and business worlds.

In addition to cosponsoring

The National Mortgage Settlement

Conference, the center hosted

a special program, “Lawless

Devils: Corruption, Politics, and the

Law.” Speakers Bethany McLean,

award-winning journalist and

coauthor of

All the Devils Are Here

,

and Professor Steven Ramirez,

director of the center, discussed the

causes and effects of the subprime

meltdown from a legal and human

perspective. Ramirez’s book

Lawless

Capitalism: The Subprime Crisis and

the Case for an Economic Rule of Law

was published last fall.

Center for Public

Interest Law

The Center for Public Interest

Law reflects the School of Law’s

commitment to the Jesuit tradition

of service to others. Directed by

Mary Bird-Murphy, the center

exposes students to meaningful

extracurricular and volunteer

opportunities that advocate for

and empower underprivileged

members of our community.

Approximately 650 Loyola law

students—more than two-thirds of

the student body—participated in

public service activities during the

2012–13 academic year, including

implementing a course for inner-

city high school students on the US

legal system, distributing food and

clothing to homeless clients, working

with the Chicago Coalition for the

Homeless to spread the word on

the educational rights of children

in temporary living situations, and

organizing an initiative to assist

Chicago-area high school students

in preparing for their ACT exams.

At the May commencement, 146

members of the Class of 2013

received Public Interest Recognition

and 73 students received Leadership

and Service Recognition.

Institute for

Investor Protection

The Institute for Investor Protection

is a nonpartisan, independent

academic center that promotes

investor protection for the

individual consumer and the

public, and seeks to shape policy

issues affecting investors. The

institute educates investors on the

private remedies envisioned by

Congress and the judiciary to deter

disclosure violations.

Nobel Prize-winning psychologist

Daniel Kahneman, author of

Thinking,

Fast and Slow

, delivered the keynote

address at Loyola’s second annual

Institute for Investor Protection

Conference, “Behavioral Economics

and Investor Protection,”where

distinguished jurist Hon. William T.

Hart (JD ’51) and leading scholars,

expert witnesses, and practitioners

debated and discussed the

application of behavioral economics

to critical aspects of securities fraud

litigation. The

Loyola University

Chicago Law Journal

presented

articles and speeches from the

gathering in its Special Conference

Issue published this summer.

Other academic

specialties

Beyond its Centers of Excellence and

institutes, the School of Law offers

several additional programs that

reflect Loyola’s strengths and allow

students to focus on a particular

area of interest. Loyola law programs

of focus include the Intellectual

Property Law Program, International

Law and Practice Program, Law

and Religion Program, and Tax Law

Program. These initiatives offer

concentrated curricula and additional

learning experiences such as

externships, symposia, journals,

and service projects.

Loyola law professors possess a wealth of specialized

expertise, and the curriculum has evolved to take full

advantage of the School of Law faculty’s depth of experience.

In addition to the Centers of Excellence, the law school is

home to several centers and institutes that further teaching,

research, and policy in areas in which Loyola leads.

Other

specialty

programs

Institutes and centers leverage Loyola strengths

COLOR IS FOR APPROXIMATION ONLY – DO NOT USE FOR COLOR APPROVAL

Loyola

University Chicago

Law Journal

BEHAVIORAL ECONOMICS AND

INVESTOR PROTECTION CONFERENCE

Behavioral Economics and Investor Protection: Keynote Address

Daniel Kahneman

Behavioral Finance before Kahneman

Richard A. Posner

Daniel Kahneman’s Influence on Legal Theory

Russell Korobkin

A Behavioral View of Investor Protection

Thomas S. Ulen

What Kahneman Means for Lawyers: Some Reflections on

Charles W. Murdock and

Thinking, Fast and Slow

Barry Sullivan

Building On Kahneman’s Insights in the Development of

Behavioral Finance

Hersh Shefrin

Behavioral Science and Scienter in Class Action Securities

Fraud Litigation

Ann Morales Olazábal

Conjoining “Recklessness” in Securities Fraud Cases to

Moral Culpability

Jed S. Rakoff

The Dangers of Missing the Forest: The Harm Caused By

Carol V. Gilden,

VeriFone Holdings

in a

Tellabs

World

Michael B. Eisenkraft,

and Josh Segal

Rewiring the DNA of Securities Fraud Litigation:

Amgen

’s

Missed Opportunity

Geoffrey Rapp

Behavioral Economics and Investor Protection: Reasonable

Investors, Efficient Markets

Barbara Black

Behavioral Economics Applied: Loss Causation

Robert A. Prentice

Foreword by Michael J. Kaufman

Volume 44

Number 5

Summer 2013

Second Annual Institute for Investor Protection Conference:

Behavioral Economics and Investor Protection

October 5, 2012

Special Conference Issue Published By:

Loyola University Chicago Law Journal

Philip H. Corboy Law Center

25 East Pearson Street, Chic go, Illinois

http://www.luc.edu/law/student/publications/llj/index.html

Loyola University Chicago

Law Journal

Pages

1323

1565

Volume 44 | No. 5 | Summer 2013

lch44-5_cv_lch44-5_cv 5/15/2013 2:05 PM Page 2

The

Loyola University Chicago Law Journal

dedicated its Summer 2013 issue to articles from

the Behavioral Economics and Investor Protection Conference.

1 2

L O Y O L A U N I V E R S I T Y C H I C A G O S C H O O L O F L A W

2 0 1 2 – 1 3 D E A N ’ S A N N U A L R E P O R T

1 3